Step-by-Step Guide: How to Apply for CM Punjab Asaan Karobar Card Scheme

Learn how to apply for CM Punjab Asaan Karobar Card with our step-by-step guide to simplify your business startup or expansion process. Starting or expanding a business can be challenging, especially when finances are tight. If you’re from Punjab, Pakistan, it’s a great opportunity to start or expand your business with interest-free business loans. The Chief Minister’s Asaan Karobar Card Scheme offers interest-free loans of up to PKR 1 million to small entrepreneurs, helping boost economic growth in the region. Before you apply on official portal https://akc.punjab.gov.pk/login let’s go through the application process step by step.

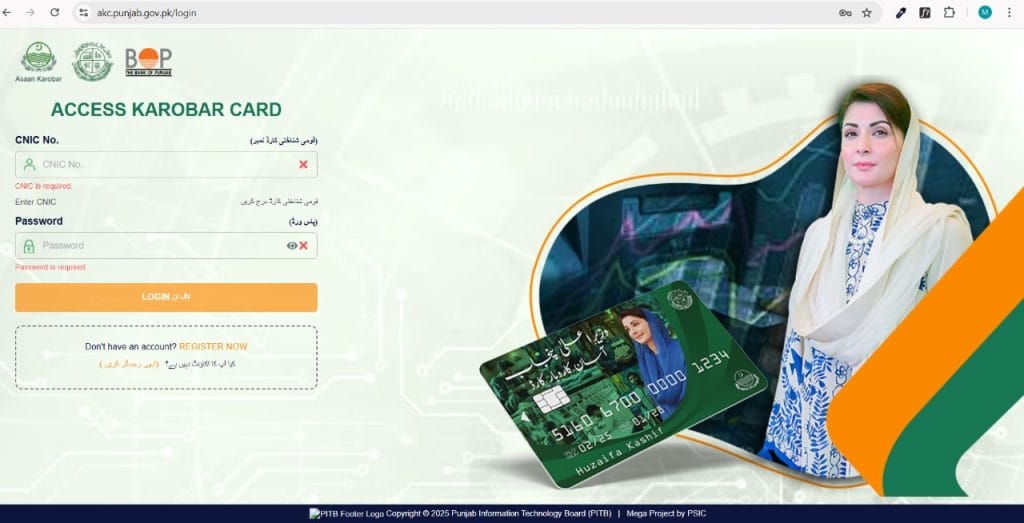

Note: Many users have reported that the site link https://akc.punjab.gov.pk/login is inaccessible or not opening. Please try accessing the link on a laptop or desktop computer, as it may not respond properly on a mobile browser.

How to Apply for CM Punjab Asaan Karobar Card Scheme

CM Punjab Directs BoP to Speed Up Asaan Karobar Scheme Loans

Step 1: Check Your Eligibility to Apply for CM Punjab Asaan Karobar Card

Before applying, ensure you meet the following criteria:

• Age: You must be between 21 and 57 years old.

• Residency: You should be a Pakistani national residing in Punjab.

• Identification: You must have a valid Computerized National Identity Card (CNIC).

• Mobile Number: Your mobile number must be registered in your name.

• Business Status: You should either own an existing business or plan to start one in Punjab.

• Credit History: A clean credit record with no overdue loans is required.

• Application Limit: Only one application per person and business is allowed.

If you meet these criteria, you can proceed with the application.

Step 2: Gather Required Documents

Preparation is key. Make sure you have the following documents:

• CNIC (Scanned copies of front and back).

• Photograph (A clear passport-sized photo or selfie).

• Proof of Business (Documents like rent agreements, ownership papers, or business registration certificates).

• References (Details of two non-relatives, including their CNIC copies and contact numbers).

Having these ready will make the application process smoother.

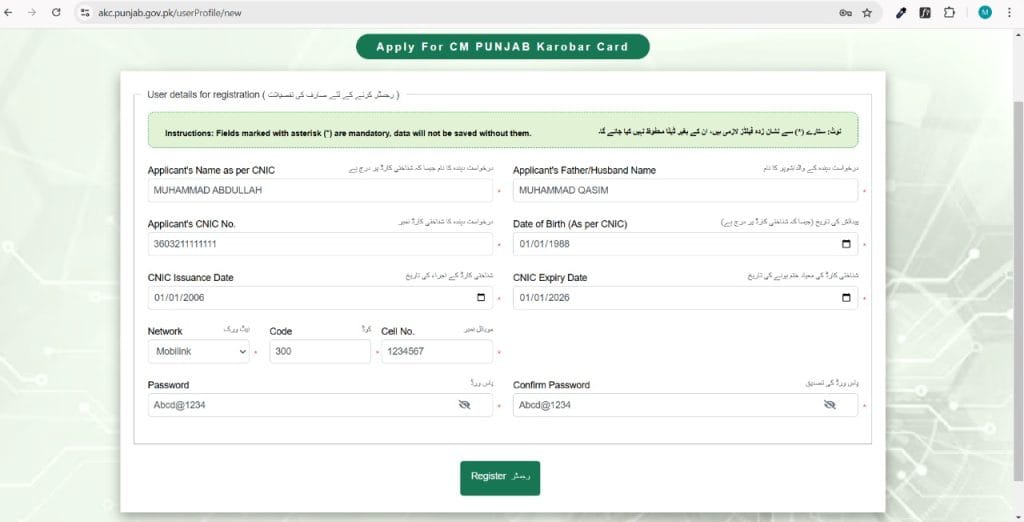

Step 3: Register on the Official Portal to Apply for CM Punjab Asaan Karobar Card

With your documents in hand, it’s time to apply online:

1. Visit the Official Portal: Open the Asaan Karobar Card Login website https://akc.punjab.gov.pk/login.

2. Sign Up: Click on RESITER NOW to register using your mobile number (it must be registered in your name) for CM Punjab Asaan Karobar Card apply online.

3. Fill in your correct Personal Information including Name, Father’s Name, CNIC, Date of Birth, CNIC Number with Issue and Expiry Date, Mobile Number with correct Mobile Network, and Create a Password: Set a strong password for security. (Tip: Use 8 character password, a capital letter at the start, a special character, and numbers as shown in the screenshot below)

This portal is designed to make the application process easy for users.

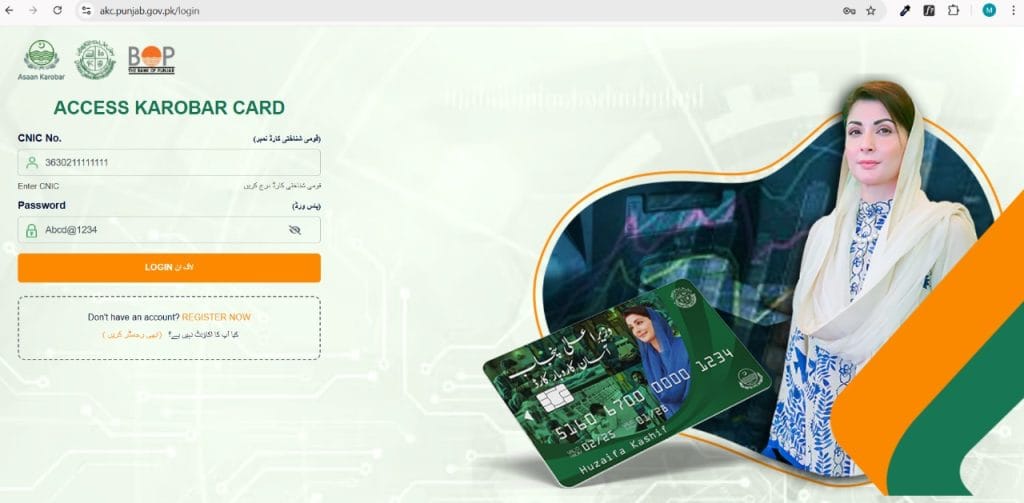

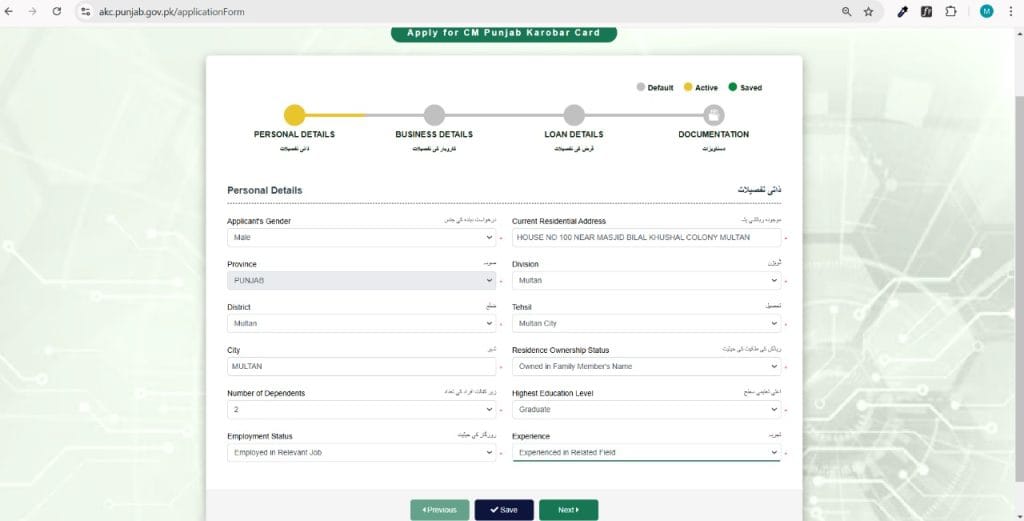

Step 4: Complete the Application Form

Once registered:

1. Login using your CNIC number and password.

For the steps below always press Save Button before pressing the Next Button, else the data will not be saved.

2. Enter your complete address with the nearest landmark, city, ownership status, family information, education, related experience, and other required information.

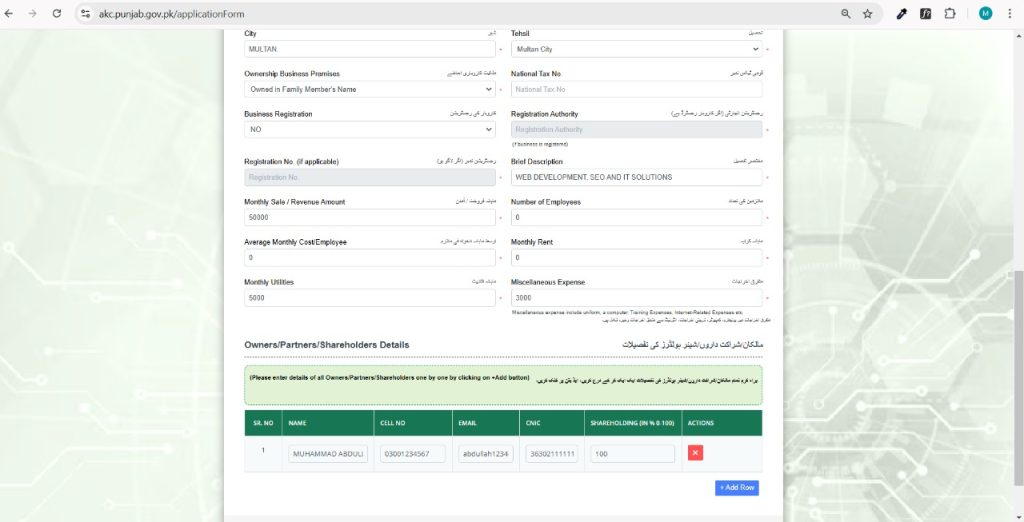

3. Enter your existing or proposed business status, its nature, start date, business name, contact details, phone, email, and other required information.

4. Enter your existing or proposed business city, business place status, registration status, description, sales, revenue, employees, salaries, utility bills, and any other expenses. Fill in your personal information name, cell, email, CNIC, and 100% ownership status if you are the sole owner of the business.

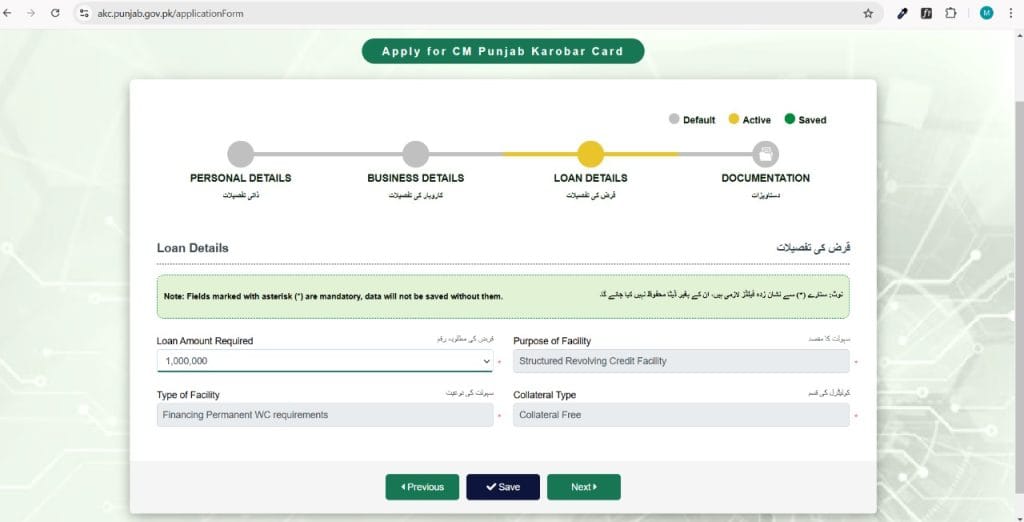

5. Enter your required loan amount ranging from Rs.100,000 to Rs.1,000,000 (One Lac to One Million) depending your business needs. The purpose of the loan is auto-filled as Revolving Credit for Business Working Capital requirements and needs no tangible security.

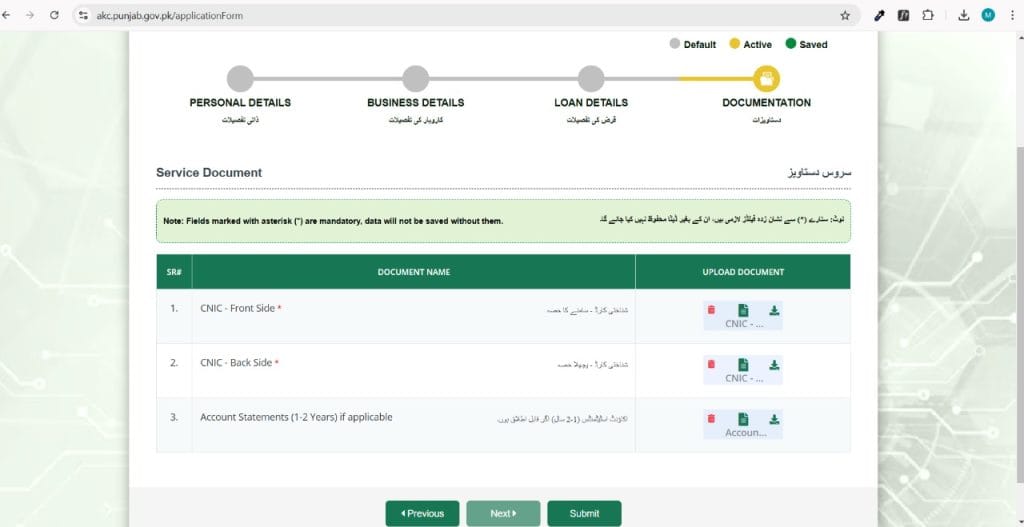

6. Attach the CNIC copy image from Front & Back. Attach the 1-2 Years Bank Statment of Account if you do have one, it will have the plus points in loan approval if it contains the cash flows or money inflows and outflows reflecting your business activity.

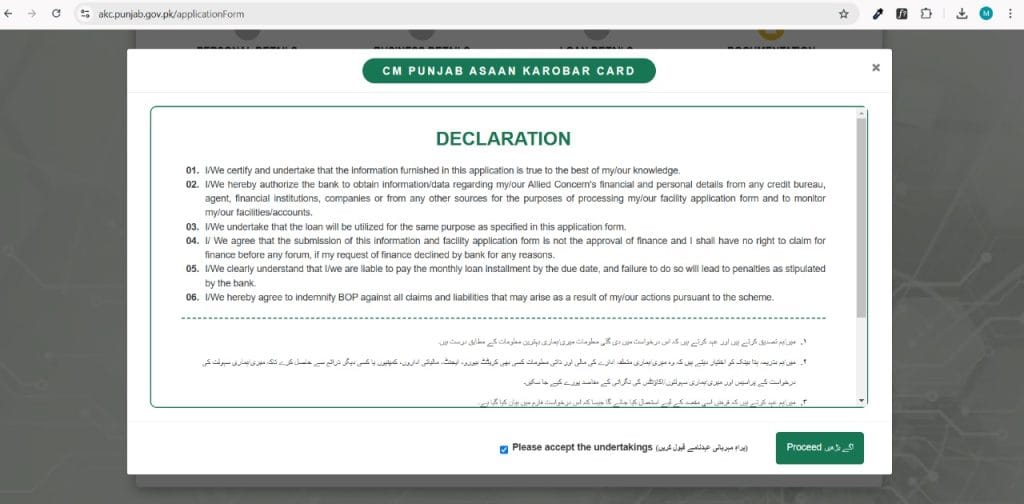

7. Next Read and Accept the Declaration by clicking the check box at the bottom stating ‘Please accept the undertaking’ and then Click the Proceed Button.

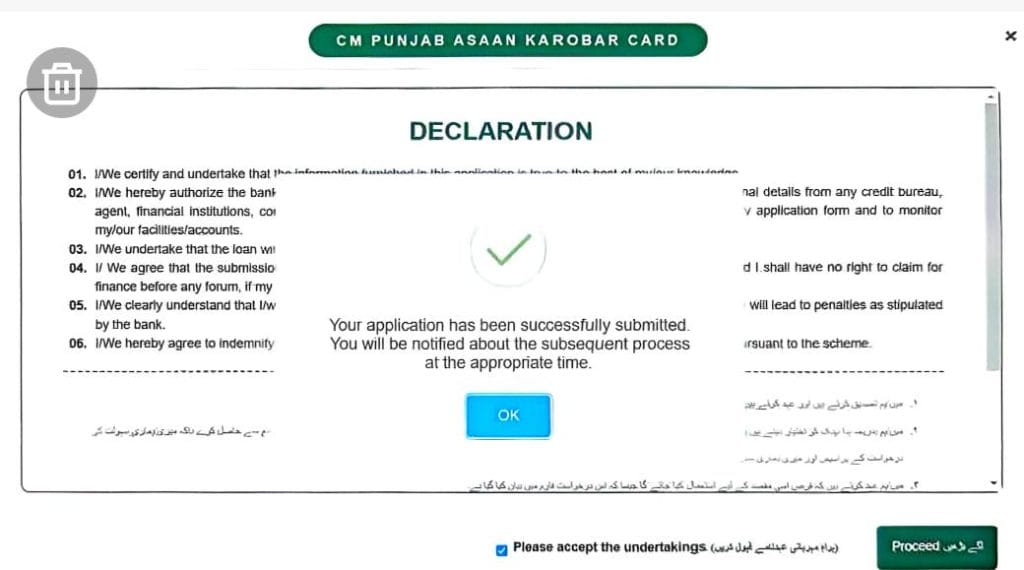

8. As you click the Proceed Button, the system will show you the following message for successful application submission.

Make sure all information is accurate and complete to avoid delays.

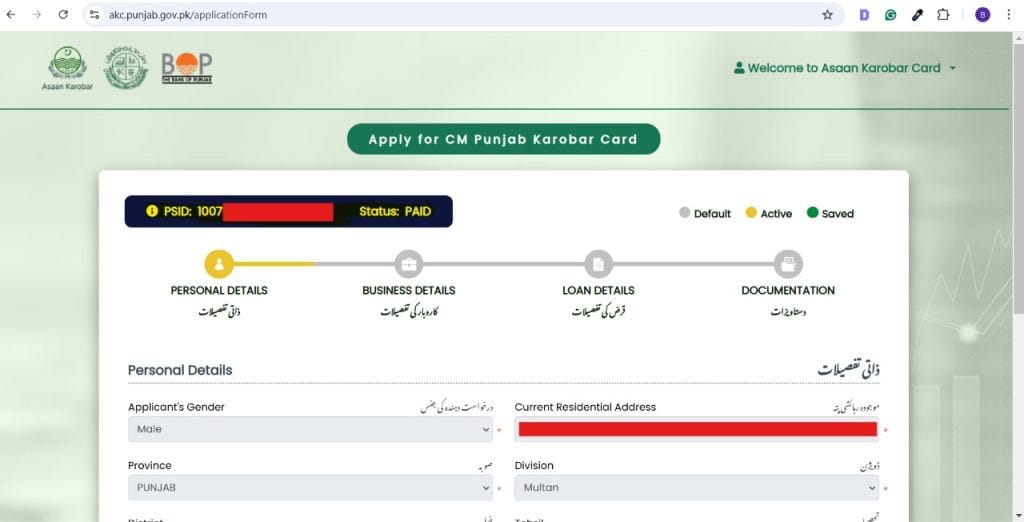

Step 5: Pay the Processing Fee – MOST IMPORTANT

To submit your application, you need to pay a non-refundable processing fee of PKR 500. The portal will display a system-generated 19-digit PSID number displayed at the top data section along with Status: UNPAID.

This 19-digit PSID can easily be paid from any Bank’s Mobile App or ATM using the 1Bill – Invoice/Fixed Payment Biller Option. The PSID can also be paid on any bank’s counter including NBP and BOP. After payment, upon fresh login, the PSID status will be updated to PAID.

Step 6: Submit the Application

- Review all the information to ensure everything is correct.

- Click ‘Submit’ to finalize your application.

After submission, you’ll receive a confirmation message and a registration number. Keep this number safe, as it will help you track your application’s progress.

Note: Sometimes, the portal does not send a reference number or confirmation message. If the submit button is disabled in your login, it means your application has been successfully submitted.

Questions and Queries about Asaan Karobar Card

- Call the dedicated helpline at 1786

- Visit the Online website at https://akc.punjab.gov.pk/cmpunjabfinance

- Visit or Call any local office of Punjab Small Industries Corporation – PSIC Offices

What Happens Next?

Once submitted, your application will go through three verification stages:

• Digital Verification: Your CNIC and personal details will be verified online, know about NADRA verification Here

• Credit Assessment: A credit history check and a psychometric assessment may be conducted. Learn about psychometric test Here. View the complete video guide on YouTube to attempt the Psychometric Test successfully

• PMD Verification: The system will check if the cell number is registered with your name, see detail Here

• Excise Verfication: The system will verify if the applicant business is legitimated and his credit worthiness with system, read detail Here.

• Filer Verfication: The system will verify if the applicant is a Tax Filer with FBR system (will be required after 6 months of loan approval). Read in detail Here.

• BOP Scrutiny: Once all verifications are done, the application will pass on to Bank of Punjab for credit decision. Read in detail Here

• Physical Verification: Officials will visit your business location within six months of loan approval and then once a year to ensure compliance.

Once the psychometric test is qualified, the applicant has to digitally accept the terms and conditions available in his account on the Asaan Karobar Card Portal. Often the Physical Verification for a new business is omitted by Bank of Punjab.

Upon approval of the loan, the cardholder must provide a personal guarantee for the repayment of the loan.

If all checks are cleared, you will receive your Asaan Karobar Card, granting access to the loan facility.

Save Extra Taxes – Be Filer Today

Save your money and be a tax filer and responsible citizen today. Save half of the taxes on the purchase of vehicles and registration expenses.

Being Filer and saving money is just a click away.

Key Features of the Asaan Karobar Card

This scheme offers flexible and easy-to-use financial assistance for small business owners. Here’s what you get:

• Loan Amount: Up to PKR 1 million.

• Loan Tenure: 3 years with a revolving credit facility in the first year.

• Repayment Terms: After the first 12 months, the balance is repaid over 24 equal monthly installments.

• Grace Period: A three-month grace period before repayments begin.

• Usage: The loan can be used for:

• Vendor and supplier payments

• Utility bills

• Government fees and taxes

• Digital transactions (POS, mobile apps, etc.)

• Cash withdrawals (limited to 25% of the credit limit for business purposes)

This card gives entrepreneurs financial flexibility without interest burdens, making it a game-changer for small businesses in Punjab.

Additional Support for Entrepreneurs

To further assist business owners, feasibility studies for startups are available through the Punjab Small Industries Corporation (PSIC) and the Bank of Punjab (BOP) websites.

With the CM Punjab Asaan Karobar Card Scheme, small business owners now have an easy and affordable way to access funds, grow their businesses, and contribute to the economic development of Punjab.

If you meet the eligibility criteria, don’t miss this opportunity! Apply today and take your business to the next level!

Read more about the Welfare Schemes, Economy, Taxation, Finance, and News here.

I need money 10 lakh. My medical store business

Please follow the link provide in above article and fill in the required detail. Submit the application and despoit fee of Rs.500/- for the provided PSID as the application is submitted.

You need to apply on the provided link to participate in the ballot.

car laon

It’s a business loan, Apply online at http://akc.punjab.gov.pk/

is the processing fee rs 5000 for T1 refundable?

The processing fees for the Punjab Asaan Karobar Finance Scheme are non-refundable. For Tier 1 loans (Rs. 1 million to Rs. 5 million), the processing fee is Rs. 5,000, and for Tier 2 loans (Rs. 6 million to Rs. 30 million), it is Rs. 10,000. Additionally, there is an annual card fee of PKR 25,000 plus FED, which is deducted from the approved loan limit. These fees cover administrative costs and are essential for processing the application

sir muje loan chahia kya karo

online apply kren, https://acag.punjab.gov.pk/

grammar cant show me bhabhi

dak khana qaim bharwana Mozambique bodhoana ,tahsil shorkot district jhang.

Pls apply on the link https://akc.punjab.gov.pk/login

mara bhi agar kisi na karza ky liya apply karna ho tw kasa karan

read the artilce carefully and apply on the link https://akc.punjab.gov.pk/login as per steps provided in the article

Abbas al shazad

pls apply online

mera card agya hy mje kese pta chlega k mera total kitna loan approve hua hy fist time jb card activation ki to 97100 ki amount thi account me plZ guide how to check

call helpline written on the card

I need 10Lakh mony

Follow the Assan Karobar Card link in the article and apply online.

rahatrahataliqureshi@gmail.clogin please

Pls apply on the link https://akc.punjab.gov.pk/login

it’s not open many times I ill try

Please use the follwoing link to apply online for a loan for the business you can do:

https://akc.punjab.gov.pk/landing

assalamu alaikum sir Maine karobar ke liye card ka apply karna hai per reply Nahin ho raha please mujhe help chahie

Pls apply for CM Punajb Asaan Karobar Card online at https://akc.punjab.gov.pk/login

Follow the Assan Karobar Card link in the article and apply online.

Pls apply on the link https://akc.punjab.gov.pk/login

assalamu alaikum sir Maine karobar ke liye card ka apply karna hai per reply Nahin ho raha please mujhe help chahie

Pls apply for CM Punajb Asaan Karobar Card online at https://akc.punjab.gov.pk/login

Respected CM Punjab Maryam Nawaz Sharif sahiba,

i want to expand my small business of electronics,This is the best step (good initiative) for the prosperity of the people. We’re grateful to you.

so please issue me a loan amounting to Rs, of 10 million.

Warmest regards,

Imran Ullah khan

Lahore.03214360121

read the article in deatil and follpw the stemps to apply online at https://akf.punjab.gov.pk/login

10 lac

Apply online at http://akc.punjab.gov.pk/

I need 25 lakh money

For new business apply upto 10 lac at https://akc.punjab.gov.pk/login

For old business apply online at for above 10 lac https://akf.punjab.gov.pk/login

#ir plz help

Apply online at https://akc.punjab.gov.pk/login

dary fam

please apply on the link https://beingfiler.com/punjab-livestock-card-for-livestock-farmers/

10 lac

Apply online at http://akc.punjab.gov.pk/

3230211789703

03017451470

Pls apply online on the link https://akc.punjab.gov.pk/login

dak khana qaim bharwana Mozambique bodhoana ,tahsil shorkot district jhang.

Pls apply online on the link https://akc.punjab.gov.pk/login

Please apply online on the link https://akc.punjab.gov.pk/login

l need 1o lakh money.

Pls apply online on the link https://akc.punjab.gov.pk/login

plz halloumi

Follow the steps provided in the article.

I Need for 30 lakh for jewelry business

Apply online on the link https://akf.punjab.gov.pk/landing

yha open q Ni ho rha ha

Pls apply on the link https://akc.punjab.gov.pk/login

mostly mobile pr ye links open ni horahe laptop or pc pr try kreen hojayega open link

Please use the follwoing link to apply online

https://akc.punjab.gov.pk/landing

arshad8628109@gmail.com

all deatil mentioned in the artcile. Its an interest free loan. apply online at https://akc.punjab.gov.pk/login

alishan

apply online at the link

login asan

Pls apply on the link https://akc.punjab.gov.pk/login

rahatrahataliqureshi@gmail.co

Pls apply on the link https://akc.punjab.gov.pk/login

Mujy karobar ka Liya loans chya

Pls apply on the link https://akc.punjab.gov.pk/login

I need a 5 lack money to start a new business and how much will be aporn

all deatil mentioned in the artcile. Its an interest free loan. apply online at https://akc.punjab.gov.pk/login

arshad8628109@gmail.com

all deatil mentioned in the artcile. Its an interest free loan. apply online at https://akc.punjab.gov.pk/login

My new business start Electric and sentry store I am interested loan card for apply

apply online at https://akc.punjab.gov.pk/login.

ch.usama.usama06@gmail.com

apply online at https://akc.punjab.gov.pk/login.

open ni ho raha

apply on link https://akc.punjab.gov.pk/login

Sir, how to check the application status?

Call at helpline 1786, they will guide you about the status.

AC and fariga makan

For new business apply upto 10 lac at https://akc.punjab.gov.pk/login

For old business apply online at for above 10 lac https://akf.punjab.gov.pk/login

rozgar

For new business apply upto 10 lac at https://akc.punjab.gov.pk/login

For old business apply online at for above 10 lac https://akf.punjab.gov.pk/login

Aslamo alikum Sir Loan chahiya karobar ky liya 03280083010

For new business apply upto 10 lac at https://akc.punjab.gov.pk/login

For old business apply online at for above 10 lac https://akf.punjab.gov.pk/login

Sir Aslamo alikum loan chahiya karobar ky liya 03280083010

For new business apply upto 10 lac at https://akc.punjab.gov.pk/login

For old business apply online at for above 10 lac https://akf.punjab.gov.pk/login

last 15days se try kar raha hun ye website open hoti hay us k baad stuck ho jati hay ye kya masla hay,,

Preferably use laptop or PC to apply online, some users are facing issues on Android mobile phones.

First read and understand the article and then open this link to apply https://akc.punjab.gov.pk/login

Also inform us if you were opening the above link or any other one?

Aslamo alikum Sir Loan chahiya karobar ky liya please Mujhy invite me bohat zayada pareshan ho plz help me mam sir thanks

For new business apply upto 10 lac at https://akc.punjab.gov.pk/login

For old business apply online at for above 10 lac https://akf.punjab.gov.pk/login

10lack new karubar ke lieye

karubar instaba karne ke lieye .

For new business apply upto 10 lac at https://akc.punjab.gov.pk/login

For old business apply online at for above 10 lac https://akf.punjab.gov.pk/login

Many dukan banani

Pls apply online at https://akc.punjab.gov.pk/login

help karo sir

Apply online at http://akc.punjab.gov.pk/

aslam o alikum mmujhy karoobar karza chahy

Apply online at https://akc.punjab.gov.pk/login

bhai Maine transport ka kam karta hun mujhe bhi card chahie

Apply online at https://akc.punjab.gov.pk/login

I have applied already and msg receive to complete steps but on portal account is hold on psychometric assessment and help line 1786 is not responding on my calls

please guide me how to resolve this login error?

If your psychometric test is passed, you will be getting the approval soon.

I need 10 lac loan for business my business is baryani shop

Please use the follwoing link to apply online for a loan for the business you can do:

https://akc.punjab.gov.pk/landing

I need 10 lac loan for business my business is baryani shop 03087980974

Please use the follwoing link to apply online for a loan for the business you can do:

https://akc.punjab.gov.pk/landing

I have explore machine made coconut oil and canola oil mustard oil I want lone

Please use the follwoing link to apply online for a loan for the business you can do:

https://akc.punjab.gov.pk/landing

need lone I want extend my small oil business

Please use the follwoing link to apply online for a loan for the business you can do:

https://akc.punjab.gov.pk/landing

Muhammad shahid shah from Rahim Yar Khan I need loan 1000000

Please use the follwoing link to apply online for a loan for the business you can do:

https://akc.punjab.gov.pk/landing

I’m an orphan girl please help us with your grace we leave in a rented house My mother is old lady please help us with your grace

Please use the follwoing link to apply online for a business loan you can do:

https://akc.punjab.gov.pk/landing

I’m an orphan girl please help us with your grace we leave in a rented house My mother is old lady please help us with your grace

Please use the follwoing link to apply online for a business loan you can do:

https://akc.punjab.gov.pk/landing

naveedali0891@gmail.com

Please use the follwoing link to apply online for a loan for the business you can do:

https://akc.punjab.gov.pk/landing

pvc wall panel manifacture

Please use the follwoing link to apply online for a loan for the business you can do:

https://akc.punjab.gov.pk/landing

m naveed

Pls apply for CM Punajb Asaan Karobar Card online at https://akc.punjab.gov.pk/login

m naveed 0333 4813504

Pls apply for CM Punajb Asaan Karobar Card online at https://akc.punjab.gov.pk/login

m naveed 03334813504

Pls apply for CM Punajb Asaan Karobar Card online at https://akc.punjab.gov.pk/login

I need 35lac for create new house. how to apply for loan.

Its a buiness loan not for house construction.

For business loan apply upto 10 Lacs on https://akc.punjab.gov.pk/login

For business loan apply upto 30 Carors on https://akf.punjab.gov.pk/landing

For House loan apply on https://acag.punjab.gov.pk/

asifkamboh539@gmail.com

apply on the link https://akc.punjab.gov.pk/login

need loan for live stock business

apply on the link https://akc.punjab.gov.pk/login

Additioanlly for livestock, approch your city relevant live stock office.

Please use the follwoing link to apply online for a loan for the business you can do:

ok

I have a plan to start a new business in Punjab. what type of documents are required before applying for loan online. PLZ guide

You just need to attach CNIC and Bank Statement

Pls apply on the link https://akc.punjab.gov.pk/login

kindly help me for decleration form submittion.

try to attach a file with size less then 200kb, for this scan your filw using camscanner mobile app and further reuct the size online using ilovepdf tool.

for any help email your problem screenshot on email info@beingfiler.com and support@beingfiler.com

abdulmajeed5127655@gmail.com

apply online at https://akc.punjab.gov.pk/login

assan karobar loan5 lakh

Please apply online at https://akc.punjab.gov.pk/login, follow the steps told in the article.

mf3886644@gmail.com

Please apply online at https://akc.punjab.gov.pk/login

Dear Sir

i applied for 10 LAKE loan {ASSAN KAROBAR CARD ] and i paid fee Rs 500 but still i do not receive any feedback about loan can you explain feedback what is expected loan and how i can get loan.

The applications are under process and will take some time to complete due to bulk of applications.

The applicants who applied earlier are getting their cards in sequesnce.

Please wait for your turn.

Asaan Karobar Card ka portal open kyu ni ho rha?

if its not opening on cell phone. try the link on laptop or desktop computer https://akc.punjab.gov.pk/login

last date kb h is program ki

No last date announced. As you apply case move on to processing and you get the card if you meet the criteria.

1000000

apply online at https://akc.punjab.gov.pk/login

100000

pls apply online

cardit card apply

apply for karobar card online at the link in the article

Reema khurram

please apply online

mera card agya hy mje kese pta chlega k mera total kitna loan approve hua hy fist time jb card activation ki to 97100 ki amount thi account me plZ guide how to check

call BOP helpline

Application Ki date extend krain Please

the scehme is extended and reopening

1000000

asaan karobar card

Apply online in the provided link in article.

Check information for Asaan Karbar card: https://cmscheme.pk/apply-cm-punjab-asaan-karobar-loan-scheme-2025/

Sir CM Punjab Ration Card Apply krny ka kya process hai??

read the article in detail

Sir, i was applied for AKC but status shows as “you have been selected for psychometric assessment” which I do not understands. Please advise me that what i do?

read the artilce https://beingfiler.com/psychometric-test-for-cm-punjab-asaan-karobar-card/

you are works very well

CM Punjab ka Asaan Karobar Card Scheme waqai chhote karobar walon ke liye ek zabardast initiative hai. Mera chhota sa clothing ka business hai, aur mujhe umeed hai is scheme se achi support milegi. Apna PMT score CNIC se zaroor check karein eligibility ke liye

I need 15 lac loan

apply here at the link https://acag.punjab.gov.pk/

I need 15 lac loan

apply here https://acag.punjab.gov.pk/

Check Asaan Karobar Loan Scheme Status If you have applied for a loan from the Punjab government under the Easy Business Finance Scheme, it is important for you to know the status of your application

very good 👍👍👍

On our website “Punjab Schemes 2025,” you will be informed in detail about all the schemes provided by the province of Punjab. You will be told on this website how to register in the schemes provided by the Government of Punjab, what the eligibility requirements are set by the Government of Punjab to complete the registration process, and what documents you have to submit to the Government of Punjab during registration.