Terms and Conditions of CM Punjab Asaan Karobar Card

The Asaan Karobar Card, introduced by the Government of Punjab, is a financial initiative designed to support small businesses and entrepreneurs. This card provides easy access to credit facilities, helping business owners manage their financial needs efficiently. However, before applying for and using the card, it is essential to understand its terms and conditions of CM Punjab Asaan Karobar Card. These guidelines outline the eligibility criteria, usage policies, repayment requirements, and other important aspects of the card. In this article, we will provide a detailed overview of these terms to ensure that you make informed decisions while benefiting from this government-backed initiative. The loan facility can be availed by applying online on the official portal.

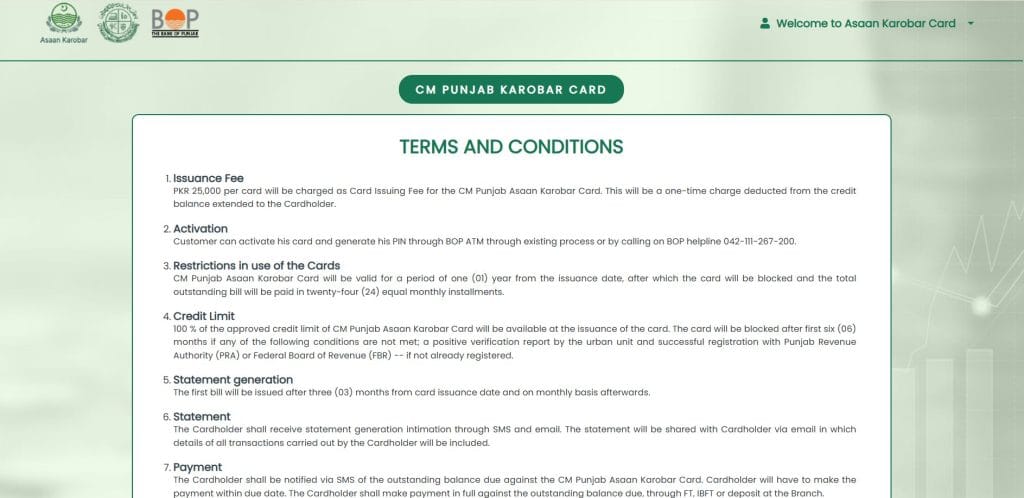

Extract of the Terms and Conditions of CM Punjab Asaan Karobar Card

Terms and Conditions of Asaan Karobar Card

The Asaan Karobar Card Terms and Conditions are stated as follows:

- Issuance Fee: 2.5% of approved loan amount up to PKR 25,000 (for 1.0Million) per card will be charged as Card Issuing Fee for the CM Punjab Asaan Karobar Card. This will be a one-time charge deducted from the credit balance extended to the Cardholder.

- Activation: Customer can activate his card and generate his PIN through BOP ATM through existing process or by calling on BOP helpline 042-111-267-200.

- Restrictions in use of the Cards: CM Punjab Asaan Karobar Card will be valid for a period of one (01) year from the issuance date, after which the card will be blocked and the total outstanding bill will be paid in twenty-four (24) equal monthly installments.

- Credit Limit: 100 % of the approved credit limit of CM Punjab Asaan Karobar Card will be available at the issuance of the card. The card will be blocked after first six (06) months if any of the following conditions are not met; a positive verification report by the urban unit and successful registration with Punjab Revenue Authority (PRA) or Federal Board of Revenue (FBR) – if not already registered.

- Statement generation: The first bill will be issued after three (03) months from card issuance date and on monthly basis afterwards.

- Statement: The Cardholder shall receive statement generation intimation through SMS and email. The statement will be shared with Cardholder via email in which details of all transactions carried out by the Cardholder will be included.

- Payment: The Cardholder shall be notified via SMS of the outstanding balance due against the CM Punjab Asaan Karobar Card. Cardholder will have to make the payment within due date. The Cardholder shall make payment in full against the outstanding balance due, through FT, IBFT or deposit at the Branch.

- Non Payment: In case the Cardholder does not make the payment by the due date, the Cardholder will need to pay off the outstanding amount along with levied charges as per Bank’s schedule of charges.

- Collection of CM Punjab Asaan Karobar Cards: The Cardholder will receive their Asaan karobar card on the current mailing address, provided by Cardholder.

- Usage: The CM Punjab Asaan Karobar card can be used worldwide for any type of purchase allowed in this scheme. Additionally, cash withdrawal up to 25% of the approved limit through ATMs shall be allowed after 6 months from the date of card issuance.

- Card Expiry: The CM Punjab Asaan Karobar Card will be blocked after twelve (12) months from issuance date and the outstanding bill will be divided into twenty-four (24) equal monthly installments.

- Billing and payment of installment plan: At 4th month the card statement will be generated and this process will continue till the 12th month. The remaining outstanding balance at the end of the 1st year would have to be repaid in Equal Monthly Installments over the next 2 years. In case the card is cancelled or terminated under the Terms and Conditions, the installment plan shall stand terminated automatically and the Cardholder shall be liable to pay the remaining installment plan amount, along with any additional due charges, immediately upon receipt of the statement of account.

- Delayed Payments: In the event of delayed payment, the Bank reserves the right to charge customers additional late payment charges as per Bank’s schedule of charges.

- Grace Period: The Cardholder must pay the dues within thirty (30) days of the date of bill statement generation.

- SMS: The Cardholder shall be notified of the card collection through SMS.

- Disclosure: The Cardholder, through the use of the CM Punjab Asaan Karobar Card, hereby irrevocably and unconditionally authorizes the Bank to disclose any information relating to the CM Punjab Asaan Karobar Card account, including but not limited to the transactions carried out, the particulars as well as the financial affairs of the Cardholder, to any third party, if and when required under the applicable law.

- Loss of Card/Disclosure of PIN: The Cardholder undertakes and warrants not to disclose the PIN to any third party and shall take all safety measures to prevent unauthorized and/or misuse of the CM Punjab Asaan Karobar Card. In the event that the CM Punjab Asaan Karobar Card is lost or stolen or the PIN is disclosed to a third party in any manner whatsoever, or in the event that the CM Punjab Asaan Karobar Card is handed over by the Cardholder to a third person, the Cardholder shall immediately notify the said loss, theft or disclosure with all material particulars, including the CM Punjab Asaan Karobar Card number, by calling Bank’s helpline as per existing process.

- Indemnity: The Cardholder undertakes and agrees to indemnify the Bank and hold it harmless against any loss, claim, action, damage, liability, cost and expense, whether legal or otherwise, which the Bank may incur due to breach of these Terms and Conditions by the Cardholder, unauthorized use of the CM Punjab Asaan Karobar Card, failure to comply with the applicable laws, rules and regulations and any third party claims due to the use or misuse of the CM Punjab Asaan Karobar Card. All costs and expenses, including legal costs and disbursements of every expense incurred by the Bank in enforcing or seeking to enforce or apply these Terms and Conditions or otherwise, shall be debited from the CM Punjab Asaan Karobar Card account and shall be paid as liabilities by the Cardholder regularly.

- General:

- The Cardholder shall be deemed to have read these Terms and Conditions and agrees to be bound by the terms hereof. These Terms and Conditions contain the whole agreement between the Cardholder and the Bank in relation to the subject matter and shall supersede all proposals, prior agreements, oral or written, and all other communications between the parties relating to the subject matter of the CM Punjab Asaan Karobar Card.

- The Bank may, from time to time and at any time, revise and/or change any of these Terms and Conditions including without limitation, the charges levied in respect of the CM Punjab Asaan Karobar Card. Such changes will be notified to the Cardholder via email / written letter. The Cardholder agrees to remain bound by these amended Terms and Conditions or any document submitted for availing the CM Punjab Asaan Karobar Card.

- Acceptance of Digital Application as Request for Credit Limit: By submitting a digital application for a credit card, the customer acknowledges and agrees that the submission of such application constitutes a formal request for the determination and assignment of a credit limit. The Bank reserves the right to assess the customer’s creditworthiness, financial history, and any other relevant factors in determining the appropriate credit limit or whether to approve or deny the requested credit limit, subject to the Bank’s internal policies and applicable regulations.

- Acceptance of Business Exclusion List: Cardholder also confirms that he/she is not conducting any business as part of the attached exclusive list. The said specific exclusion shall be applicable for any type of facility which have received credit approvals from July 01, 2024 onwards. The Bank will not finance:

- Production or trade in any product or activity deemed illegal under Pakistani laws or regulations or international conventions and agreements or subject to local/international banks such as pharmaceuticals, pesticides/herbicides, ozone depleting substances, PCBs, wildlife or products regulated under CITES.

- Ship breaking/ trading activities which include:

- Ships with prevalent asbestos use (for e.g. passenger cruise)

- Ships listed on the Greenpeace blacklist

- Ships not certified “gas free” for hot work

- Unsustainable fishing methods (e.g. blast fishing and drift net fishing in the marine environment using nets in excess of 2.5 km in length, deep sea bottom trawling, or fishing with the use of explosives or cyanide)

- Illegal logging, commercial logging operations, or conversion of land for plantation use in primary tropical moist forest. Production or trade in wood or other forestry products other than from sustainably managed forests.

- Production or activities involving harmful or exploitative forms of modern slavery, human trafficking, forced labor or child labor.

- Any activity, production, use, distribution, business or trade involving:

- Unbounded asbestos fibers.

- Destruction of High Conservation value areas, including impacting UNESCO World Heritage Site and/or Ramras sites

- Racist and/or anti-democratic media.

- Pornography (goods, stores, web-based) and/or prostitution.

- Tobacco and tobacco products.

- Gambling, casinos and equivalent enterprises.

- Alcoholic beverages including beer and wine.

- Production or trade in unbounded asbestos fibers. This does not apply to the purchase and use of bonded asbestos cement sheeting where the asbestos content is less than 20%.

- Radioactive materials including nuclear reactors and components thereof. This does not apply to the purchase of medical equipment, quality control (measurement) equipment and any equipment where the radioactive source to be trivial and/or adequately shielded.

- Production or activities that impinge on the lands owned, or claimed under adjudication, by Indigenous Peoples, without full documented consent of such peoples.

- Production, trade, storage, or transport of significant volumes of hazardous chemicals, or commercial scale usage of hazardous chemicals/substances. Hazardous chemicals include gasoline, kerosene, and other petroleum products. The Pakistan Hazardous Substance Rules 2003 indicate licenses and permits are required for handling significant volumes of hazardous chemicals and make provisions for the granting of licenses for the collection, treatment, storage, importation, and transportation of hazardous substances; the rules prohibit the financing of businesses without proper licenses.

- Production or trade in weapons and munitions with the exception of Facilities offered directly to the GOP.

- Cross-border trade in waste and waste products.

- Production or trade in wood or other forestry products other than from sustainably managed forests.

Note: These Terms and Conditions of Asaan Karobar Card are compulsory and accepted by the applicant and digitally verified through OTP on the registered mobile number with a digital timestamp in the login of the CM Punjab Asaan Karobar Portal.

Step-by-Step Guide to Apply for CM Punjab Asaan Karobar Card Scheme – Click Here

Summary of the Terms and Conditions CM Punjab Karobar Card

The Asaan Karobar Card, issued by the Government of Punjab, has a one-time issuance fee of PKR 25,000, deducted from the approved credit limit. The card is valid for one year and can be activated via BOP ATM or the BOP helpline. Cardholders receive 100% of the approved credit limit upfront, but after six months, the card will be blocked unless the holder meets verification requirements, including a positive report from the Urban Unit and registration with PRA or FBR. The card can be used worldwide for approved transactions, and cash withdrawals of up to 25% of the credit limit are permitted after six months states the terms and conditions CM Punjab Karobar Card.

The cardholder must provide a personal guarantee, making them fully responsible for repaying the outstanding balance in case of default states the terms and conditions karobar card as per terms and conditions of Asaan Karobar Card.

Billing starts three months after issuance, followed by monthly statements via SMS and email. Payments must be made within 30 days of the statement date to avoid late payment charges. If the cardholder fails to make payments, the bank may impose penalties and recover the outstanding balance. After one year, any remaining balance is converted into 24 equal monthly installments. Failure to comply with the terms may result in card termination, legal action, or additional charges. The cardholder is responsible for safeguarding their PIN, and any loss or unauthorized use must be reported immediately. The bank reserves the right to amend these terms at any time, with prior notice to the cardholder states the Terms and Conditions of Asaan Karobar Card.

Read more about the Govt Schemes, Economy, News and Announcements here.

Kam ka Lana Lona Lana ha please

pls apply online at the link

bhainson ka Karobar karna hai

apply online at https://beingfiler.com/punjab-livestock-card-for-livestock-farmers/