Meezan Bank Launches Interest Free Bike Financing at Zero Percent (0%) – Pursuing Regulatory ADR Targets

Meezan Bank Bike Installment Plan for Bike with Financing at Zero Percent Profit Rate

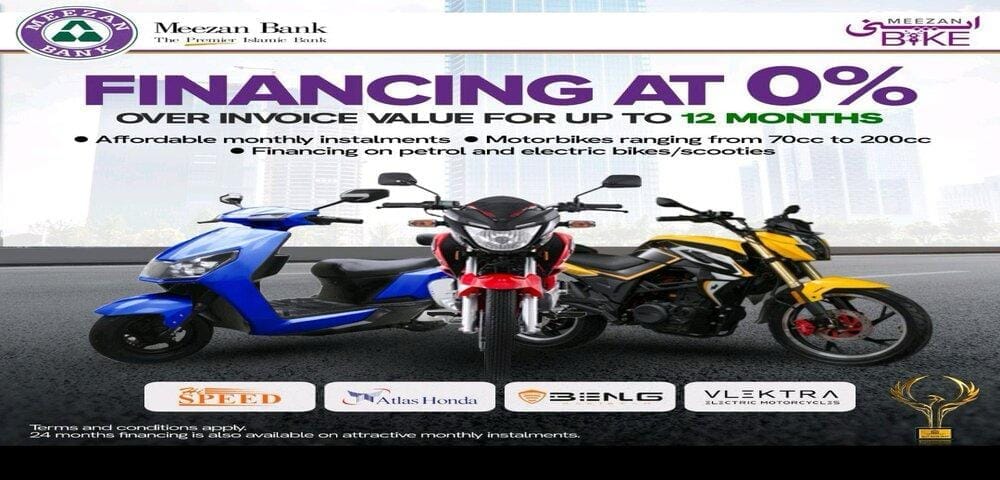

Meezan Bank has introduced an innovative scheme for financing at zero percent profit rate for 70cc to 200cc petrol and electric bikes, including scooties. This move is part of the bank’s strategy to meet the Advance-to-Deposit Ratio (ADR) targets and avoid the 10% additional tax imposed on banks not meeting lending quotas. The financing plan offers affordable monthly installments, making it easier for customers to purchase motorbikes while contributing to sustainable transportation options with electric bikes.

With the increasing demand for motorbikes in Pakistan due to rising fuel costs and urban mobility challenges, this financing scheme is expected to benefit a wide range of customers, including young professionals, students, and delivery service workers. Additionally, the Meezan Bank Bike Scheme for Govt Employees offers an exclusive financing option tailored for public sector workers, ensuring they have access to affordable and convenient bike ownership. The zero-percent profit rate aligns with Islamic financing principles, making it accessible to more customers while promoting the use of environmentally friendly electric bikes.

Key Features of Meezan Bank Islamic Bike Financing Scheme

Zero-Profit Rate: Customers can finance motorbikes without paying any additional profit, a rare offer in the market.

Flexible Tenure: The installment plans are designed to be affordable, with monthly payments spread over a convenient tenure to suit a wide range of income levels.

Vehicle Options: Financing is available for both petrol and electric bikes ranging from 70cc to 200cc, including scooties, giving customers flexibility in choosing their preferred mode of transport.

Environmentally Friendly Focus: By including electric bikes in the offer, Meezan Bank is encouraging the use of eco-friendly vehicles that can help reduce carbon emissions and support Pakistan’s green initiatives.

Benefits for Customers and Meezan Bank ADR Compliance

This financing option is not only beneficial for customers looking for an affordable, interest-free way and zero markup bike finance 2024 to purchase bikes but also supports Meezan Bank’s ADR targets. By increasing its lending activity, the bank aims to comply with regulatory requirements and avoid the hefty 10% additional tax. In doing so, the bank enhances its financial health while offering attractive products to its customer base.

Read more useful content about economy, finance and taxation here.

I want

Contact nearest Meezan Bank Account

Contact nearest Meezan Bank Branch

Pls contact nearest Meezan Bank Branch