FBR Tax Return Login: The Ultimate Guide to Tax Filing

FBR Tax Return Login portal is the online platform provided by Federal Board of Revenue (FBR) for filing FBR income tax returns by the taxpayers. For filing of returns, one should register with the income tax filing portal commonly known as the iris fbr portal. After registration, a person should enroll with the iris system through the e-enrollment link. Once registered and enrolled, the user will get the fbr login also called iris login. The login information will then be used to login to the iris tax portal. After logging in to the tax portal, the user can file his tax returns.

Recently, a new version of IRIS 2.0 has been launched, which is a new experience for taxpayers to file their returns with easy, modern, and fast features of the tax filing system.

The new portal of FBR tax return login, provides direct links to verifications, e-payments, tax asaan, capital assets u/s 7E, FBR Maloomat, and other information to facilitate the taxpayers.

The portal provides the following information on different categories:

Online Verification Services

On the IRIS portal, one can easily access the following verification services

FBR e-payments Services

The following electronic payment services are available on the portal

- e-payment services for Income Tax, Sales Tax, and Sales Tax withholding

- e-payments for annual income tax returns

- Immovable property tax payments

- Federal Excise duty payments

- Capital Value Tax (CVT) on motor vehicles, foreign movable and immovable assets

FBR’s Tax Asaan Mobile Application

Tax Asaan Mobile Application

To better facilitate the taxpayer, a one-stop taxation mobile app has been developed for Android and iPhone users with the following features

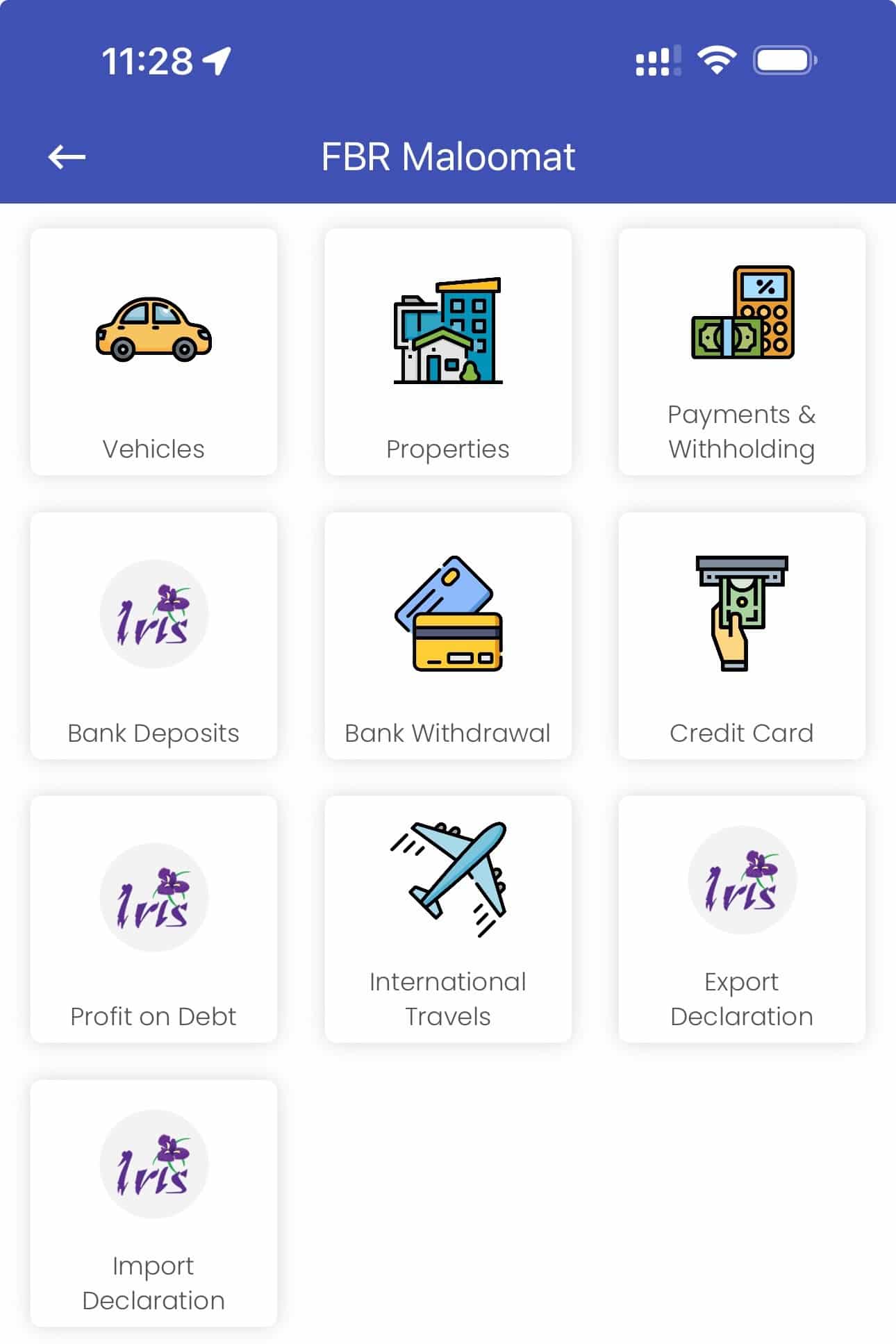

FBR Assets Inquiry Service – FBR Maloomat

FBR has introduced the Maloomat portal to facilitate the taxpayers for inquiry of the assets. The taxpayers can inquire about the following assets

Importance of FBR Tax Return Login Information

The fbr tax return login is important information of a taxpayer. The login information must be kept safe and secured and not to be shared with anyone. Anyone with the login information of the tax portal may log in to the tax system, fetch the important tax information, and make unauthorized changes to the tax information.

FBR Helpline

FBR has provided the UAN +92 51 111 772 772 that is available for working days Monday to Friday from 9 AM to 11 PM. Anyone can call to get any help regarding tax matters and the system. A query can also be raised to their registered helpline email address available on the portal.

Easy Guides and Resources of Taxation System

FAQs

Conclusion

The FBR’s Tax Return Login using iris portal offers an easy and excellent user-friendly experience, with IRIS 2.0 providing modern features to facilitate your taxation needs. The portal includes e-payments, verifications, and a separate easy-to-use mobile app, streamlining the overall tax filing processes with a robust security mechanism of securing the login information.

Participate in forums to acquire community-driven backlinks that boost your SEO efforts for SEO backlink websites 2024.

Start implementing these resources to enhance your website’s SEO performance with SEO backlink websites 2024.