Budget 2025-26: A Significant Relief for Tax on Salary 2025-26 in Pakistan

ISLAMABAD June 10, 2025: In a major policy shift aimed at easing the financial burden on working individuals a relief for tax on salary 2025-26 has been announced by the Government of Pakistan making a singnificant tax relief for salaried class in its federal budget for fiscal year 2025–26. This move comes in response to rising inflation and mounting pressure on middle-income households, which have historically borne a significant portion of the national tax load.

Finance Minister Muhammad Aurangzeb, during his budget speech, emphasized that the government’s objective extends beyond mere tax cuts—it is about restoring balance in the system and aligning salaries with the escalating cost of living. He noted that Prime Minister Shehbaz Sharif made it a personal priority to provide financial breathing room for salaried professionals, particularly those within the middle-income bracket.

Key Points of Tax Relief To Salaried Class in Budget 2025-26

پاکستان کی وفاقی حکومت نے مالی سال 2025-26 کے بجٹ میں تنخواہ دار طبقے کے لیے نمایاں ٹیکس ریلیف کا اعلان کیا ہے، جس کا مقصد مہنگائی کے بڑھتے ہوئے دباؤ اور درمیانی آمدنی والے گھرانوں پر ٹیکس کے بوجھ کو کم کرنا ہے۔ وزیر خزانہ محمد اورنگزیب نے بجٹ تقریر میں کہا کہ وزیراعظم شہباز شریف کی ہدایت پر تنخواہ دار پیشہ ور افراد، بالخصوص درمیانی آمدنی والے طبقے کو مالی سہولت دینے کو ترجیح دی گئی۔ سالانہ 600,000 سے 1.2 ملین روپے کمانے والوں کے لیےسیلری ٹیکس 2025-26 کی شرح 5 فیصد سے کم کر کے 1 فیصد کر دی گئی ہے، جبکہ 1.2 ملین سے 2.2 ملین روپے کی آمدنی والوں کے لیے یہ 15 فیصد سے 11 فیصد ہو گئی ہے، جس سے ہزاروں روپے کی بچت ہو گی۔ یہ اصلاحات نہ صرف معاشی دباؤ کو کم کرنے بلکہ ہنرمند افراد کو ملک میں روکنے اور 4.2 فیصد جی ڈی پی گروتھ کے ہدف کو حاصل کرنے کی حکمت عملی کا حصہ ہیں۔

Lower Tax Rates, Bigger Paychecks with Relief for Tax on Salary 2025-26

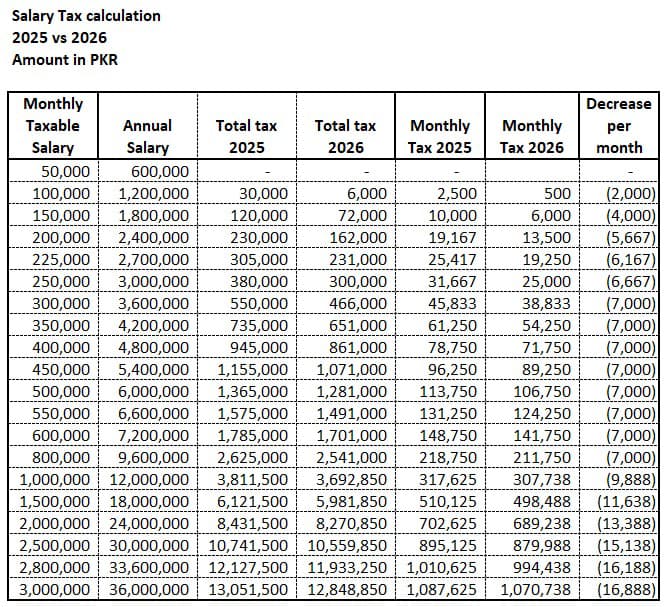

The most notable change is the substantial reduction in tax rates for individuals earning between Rs. 600,000 and Rs. 1.2 million annually. The tax rate for this group has been slashed from 5% to a minimal 1%. For example, someone with an annual income of Rs. 1.2 million will now pay only Rs. 6,000 in taxes—an 80% drop from the previous Rs. 30,000 liability.

Taxpayers falling within the Rs. 1.2 million to Rs. 2.2 million income range also stand to benefit significantly. The tax rate for this segment has been brought down from 15% to 11%, offering thousands of rupees in annual savings for individual earners. This new structure is aimed at softening the blow of inflation and increasing net disposable income.

Higher income brackets haven’t been ignored either. Individuals earning between Rs. 2.2 million and Rs. 3.2 million will see their rate trimmed to 23%, compared to the previous 25%. Further up the scale, modest relief has also been incorporated, along with a 1% reduction in the income surcharge for professionals earning above Rs. 1 million annually—a subtle but strategic move to retain top talent and curb brain drain.

Revised Tax Structure at a Glance (Effective July 1, 2025)

| Income Range (PKR) | Tax Rate |

|---|---|

| Up to 600,000 | 0% (Tax Exempt) |

| 600,001 – 1,200,000 | 1%* of the amount exceeding Rs. 600,000 |

| 1,200,001 – 2,200,000 | Rs. 6,000 + 11% of amount exceeding Rs. 1,200,000 |

| 2,200,001 – 3,200,000 | Rs. 116,000 + 23% of amount exceeding Rs. 2,200,000 |

| 3,200,001 – 4,100,000 | Rs. 346,000 + 30% of amount exceeding Rs. 3,200,000 |

| Above 4,100,000 | Rs. 616,000 + 35% of amount exceeding Rs. 4,100,000 |

* After the Finance Bill was passed with amendments by the National Assembly, the tax rate for incomes between 600,000 and 1,200,000 was finalized at 1%, replacing the previously proposed rate of 2.5%

This progressive tax model ensures that the burden remains equitable while offering meaningful relief to those in the lower and middle-income brackets.

The salary tax budget 2025-26 in Pakistan introduces a progressive tax structure, significantly lowering rates for middle-income earners, such as reducing the tax from 5% to 1% for those earning Rs. 600,000 to Rs. 1.2 million annually. The salary tax relief in budget 2025-26 also benefits higher earners with measures like a 2.5% reduction in the income surcharge for those earning above Rs. 1 million, aimed at retaining talent and boosting economic growth.

- After the Finance Bill was passed with amendments by the National Assembly, the tax rate for incomes between 600,000 and 1,200,000 was finalized at 1%, replacing the previously proposed rate of 2.5%

More Than Numbers: A Strategy for Retention and Economic Growth

Earlier Aurangzeb also highlighted another key motive behind The cabinet turned down the earlier proposal to cut the tax rate from 5% to 1%, opting instead to set it at 2.5% for the income bracket of 600,000 to 1,200,000, which is now set to 1%. Acknowledging that Pakistan’s professionals face some of the region’s steepest tax obligations, the budget introduces marginal but symbolic reliefs to discourage emigration and attract talent to stay and contribute domestically by retaining skilled workers with ongoing tax reforms.

“The government recognises that Pakistan’s top talent faces some of the highest taxes in the region,” Aurangzeb noted. “We want to give them a reason to stay.”

Furthermore, this budget is part of a broader economic vision. Despite reducing overall spending by 7%, the government aims to achieve a 4.2% GDP growth in 2025–26. Lower borrowing costs, due to a series of interest rate cuts by the central bank, are expected to stimulate investment—though experts caution that fiscal reforms will still need to catch up.

Conclusion about Relief for Tax on Salary 2025-26

The 2025–26 budget signals a paradigm shift in how Pakistan views its salaried taxpayers. By significantly lowering income tax rates for the middle class and offering measured relief to higher earners, the government has acknowledged their crucial role in national development. While structural reforms and economic recovery remain long-term goals, this move provides much-needed immediate relief—and perhaps a renewed sense of fairness—to millions of working Pakistanis.

Read more about the Economy, News and Announcements here.

2 Comments