Pakistan Budget 2025-26: Key Highlights, Sectoral Analysis, and Economic Implications

The Pakistan Budget 2025-26, presented on June 10, 2025, by Finance Minister Muhammad Aurangzeb, outlines a roadmap for economic stabilization, growth, and reform. With a total outlay of Rs17.573 trillion, the Budget 2025-26 targets a 4.2% GDP growth rate, a fiscal deficit of 3.9%, and a primary surplus of 2.4%. It emphasizes fiscal discipline, structural reforms, and inclusive development while addressing challenges like inflation, energy sector inefficiencies, and climate change. This article provides a concise overview of the Budget 2025-26 highlights, organized by sector, with sub-key points, pros and cons analysis, Budget 2025-26 taxes, and visual aids to enhance reader understanding.

Key Highlights of Budget 2025-26

بجٹ 2025 پاکستان کے مالی سال 2025-26 کے لیے پیش کیا گیا وفاقی بجٹ معیشت کے استحکام، اصلاحات، اور پائیدار ترقی پر مرکوز ہے۔ اس بجٹ کا مجموعی حجم 17.573 کھرب روپے ہے جس میں جی ڈی پی کی شرح نمو کا ہدف 4.2 فیصد اور مالی خسارے کو 3.9 فیصد تک محدود رکھنے کی کوشش کی گئی ہے۔ بجٹ میں تنخواہ دار طبقے کے لیے انکم ٹیکس میں نمایاں کمی کی گئی ہے جبکہ ایف بی آر کا ہدف 18.7 فیصد بڑھا کر 14.131 کھرب روپے رکھا گیا ہے۔ توانائی، آبی وسائل، صحت، تعلیم، زراعت، اور سوشل سیکیورٹی کے شعبوں کے لیے خاطر خواہ رقوم مختص کی گئی ہیں، خاص طور پر بے نظیر انکم سپورٹ پروگرام کا بجٹ بڑھا کر 716 ارب روپے کیا گیا ہے۔

بجٹ 2025 میں قابل ذکر اصلاحات میں ڈیجیٹل ٹیکس سسٹم، کاربن ٹیکس، اور سولر پینل پر سیلز ٹیکس شامل ہیں جن کے باعث ماحول دوست منصوبوں کی مالی معاونت ممکن بنائی جا سکے گی۔ زرعی شعبے میں کسانوں کے لیے قرضوں کی فراہمی اور بیج پالیسی کی منظوری کے اقدامات کیے گئے ہیں۔ تاہم، مہنگائی کا 7.5 فیصد ہدف عوام کی قوتِ خرید پر منفی اثر ڈال سکتا ہے۔ بجٹ میں متعدد سرکاری اداروں کی نجکاری، پنشن اصلاحات، اور فیول لیوی جیسے فیصلے سیاسی مزاحمت کا باعث بن سکتے ہیں۔ اس کے باوجود، بجٹ 2025 پاکستان کو اقتصادی ترقی، عالمی اعتماد، اور موسمیاتی چیلنجز سے نمٹنے کے لیے ایک نئے راستے پر ڈالنے کی صلاحیت رکھتا ہے، بشرطیکہ اس پر موثر عملدرآمد یقینی بنایا جائے۔

Sectoral Highlights of Budget 2025-26

1. Fiscal and Economic Framework

- Total Budget Outlay: Rs17.573 trillion, down 7% from Rs18.9 trillion in FY25.

- GDP Growth Target: 4.2%, up from 2.7% in FY25.

- Fiscal Deficit: 3.9% of GDP, reduced from 5.9% in FY24.

- Primary Surplus: 2.4% of GDP, improved from 2.0% in FY24.

- Inflation Target: 7.5%, up from 4.7% in FY25.

- FBR Revenue Target: Rs14.131 trillion, up 18.7% from FY25.

- Non-Tax Revenue: Rs5.147 trillion.

- Net Federal Revenue: Rs11.072 trillion after provincial transfers of Rs8.206 trillion.

Cons

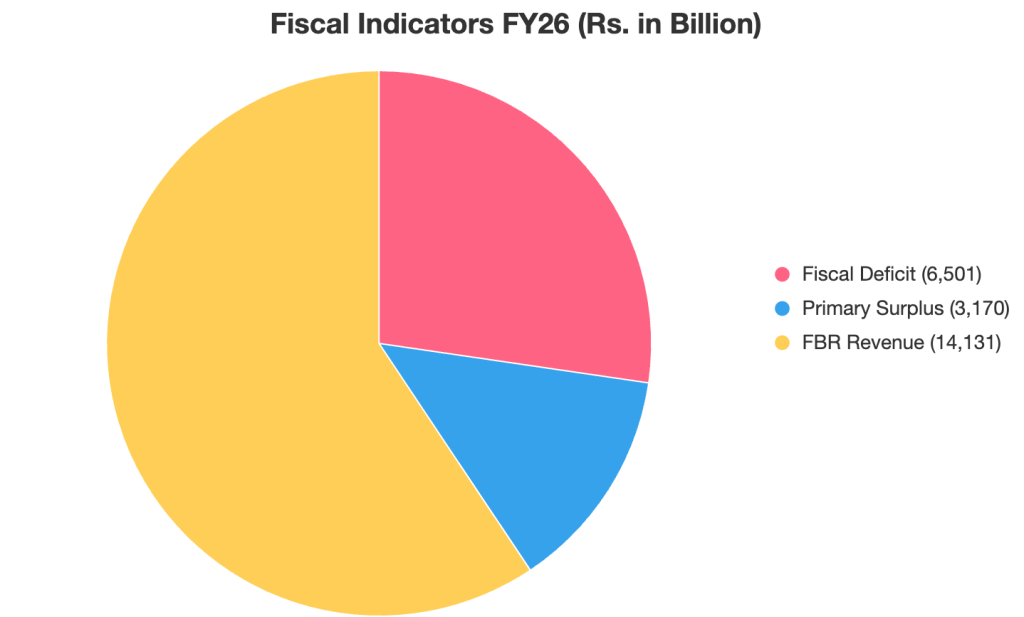

Fiscal Indicators (Rs. in Billion)

| Indicator | FY24 (Revised) | FY25 (Budget) | FY26 (Budget) |

|---|---|---|---|

| Fiscal Deficit | 7,444 | 7,438 | 6,501 |

| Primary Surplus | 1,217 | 2,492 | 3,170 |

| FBR Revenue | 11,900 | 12,970 | 14,131 |

2. Taxation and Revenue Reforms in Budget 2025-26

Tax Relief to Salaried Class:

- Tax rate reduced from 5% to 1% for income Rs600,000–1,200,000 annually. Later its revised from 1% to 2.5%.

- 15% to 11% for income up to Rs2,200,000; 25% to 23% for Rs2,200,000–3,200,000.

- Surcharge on income above Rs1 million reduced from 10% to 9%.

Corporate Tax Relief:

- Super tax under section 4C reduced by 0.5% for income slabs Rs200–500 million.

Digital Tax Enforcement:

- Digital production tracking expanded to cement, beverages, fertilizers, textiles.

- AI-based audit selection and faceless customs audits introduced.

- E-commerce platforms to deduct 18% sales tax on deliveries.

Carbon and Green Taxes:

- Carbon tax of Rs2.5/liter on petrol, diesel, furnace oil, rising to Rs5/liter in FY27.

- 18% sales tax on solar panel imports to promote local industry.

Property and Construction:

- Withholding tax on property purchases reduced (e.g., 4% to 2.5%).

- Federal excise duty (7%) on commercial property transfers eliminated.

Other Tax Measures:

- Interest income tax increased from 15% to 20% (exempting small savers).

- 5% tax on pensions above Rs10 million annually for those under 70.

- Advance tax on cash withdrawals for non-filers raised from 0.6% to 1%.

Cons

Tax Revenue Breakdown (Rs. in Billion)

| Source | FY25 (Revised) | FY26 (Budget) |

|---|---|---|

| Direct Taxes | 6,074 | 7,229 |

| Indirect Taxes | 5,826 | 6,902 |

| Non-Tax Revenue | 4,902 | 5,147 |

3. Public Sector Development Programme (PSDP)

Federal PSDP Allocation:

- Rs1 trillion, part of Rs4.224 trillion national PSDP (including Rs2.869 trillion provincial ADPs).

Transport Infrastructure:

- Rs328 billion for roads, railways, maritime, and air transport.

- Rs100 billion for Karachi–Balochistan N-25 highway.

- Rs15 billion for Sukkur–Hyderabad motorway.

- Rs7 billion for Thar Coal Rail Connectivity.

Water Resources:

- Rs133 billion for 34 water projects.

- Rs32.7 billion for Diamer-Bhasha Dam, Rs35.7 billion for Mohmand Dam.

Energy Sector:

- Rs90.2 billion for 47 energy projects, including Rs20 billion for Dasu Hydro Power, Rs35.7 billion for Mohmand Hydro.

Education and Health:

- Rs9.8 billion for 11 new knowledge schools in backward areas.

- Rs14.3 billion for 21 health projects, including Rs4 billion for Jinnah Medical Complex.

Science and Technology:

- Rs4.8 billion for 31 ongoing schemes (e.g., Pakistan-Korea PV Testing Facility).

Cons

4. Additional Fiscal Reforms in Budget 2025-26

Benazir Income Support Programme (BISP):

- Rs716 billion allocated, up 21% from FY25.

- Coverage expanded to 10 million families, educational scholarships for 1 million children.

Pension Reforms:

- 7% pension increase proposed.

- Reforms include CPI indexing, 10-year limit for surviving spouses, and single-pension rule.

Government Employees:

- 10% salary increase for grades 1–22.

- 30% disparity reduction allowance to address salary inequities.

- Special conveyance allowance for disabled employees raised from Rs4,000 to Rs6,000.

Overseas Pakistanis:

- Remittances up 31% to $31.2 billion; projected to reach $38 billion.

- Special courts, online case registration, and quotas for children in universities proposed.

Cons

5. Energy Sector Reforms

Power Sector:

- Rs1.186 billion in subsidies for electricity and other sectors.

- Electricity costs reduced by 31% for industry, over 50% for 18 million protected consumers.

- Privatization of three DISCOs (Faisalabad, Gujranwala, Islamabad) halfway complete.

- Rs140 billion in losses reduced in nine months.

Renewable and Hydropower:

- Rs67.2 billion for clean energy projects (e.g., Dasu, Tarbela).

- Rs29 billion for advanced metering infrastructure in IESCO.

Exploration and Production:

- 2024 Offshore Exploration Bid Round launched, attracting $5 billion in investments.

- Reko Diq project to generate $75 billion over 37 years, creating 41,500 jobs.

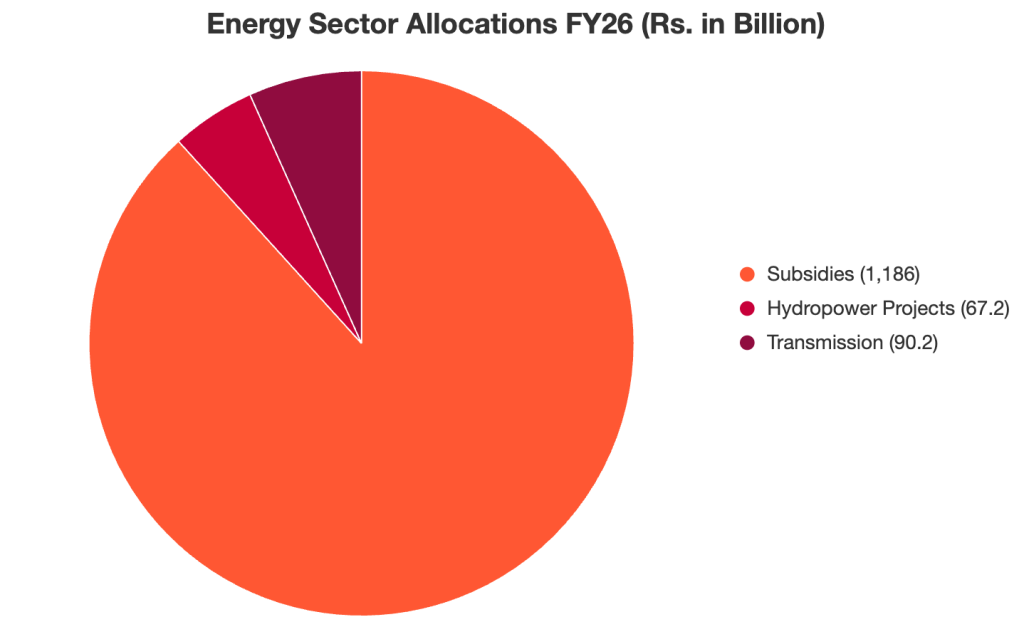

Energy Sector Allocations (Rs. in Billion)

| Category | FY26 (Budget) |

|---|---|

| Subsidies | 1,186 |

| Hydropower Projects | 67.2 |

| Transmission | 90.2 |

Cons

6. Agriculture and Rural Development

Agricultural Growth Target:

- 4.5% for FY26.

Credit Access:

- Agricultural loans up from Rs1,785 billion to Rs2,066 billion.

- Clean Financing Facility for small farmers (up to Rs100,000 collateral-free loans).

Seed and Policy Reforms:

- National Seed Development and Regulatory Authority established.

- National Seed Policy 2025 and Agricultural Biotechnology Policy 2025 near approval.

Green Pakistan Initiative:

- Focus on modern farming, crop diversification, and market access.

Cons

7. Business and Investment Climate

Tariff Reforms:

- Elimination of Additional Customs Duties (ACDs) over four years.

- Regulatory Duties (RDs) phased out in five years.

- Customs duty slabs simplified to 0%, 5%, 10%, 15%.

SIFC Initiatives:

- Over 100 greenfield and brownfield projects advanced, boosting FDI.

- Improved inter-provincial coordination and regulatory ease.

SOE and Privatization:

- PIA, Roosevelt Hotel, and DISCOs targeted for privatization.

- 45 SOEs to be privatized or closed, reducing fiscal burden.

Cons

8. Climate Change and Sustainability

Climate Finance:

- $40 billion from World Bank/IFC over 10 years.

- $1.4 billion from IMF’s Resilience and Sustainability Facility.

- Green Sukuk issued for climate projects.

Carbon Levy:

- Rs2.5/liter on fossil fuels to fund green energy.

Water Management:

- Rs133 billion for water projects to counter scarcity and Indian water threats.

- 10 million acre-feet storage increase targeted.

Cons

Save Your Money from Extra Taxes – Be Filer Today

Save your hard-earned money and be a tax filer and responsible citizen today. Note that Filers are charged half of the tax rates on many services as compared to Non-Filers.

Being Filer and saving money is just a click away.

Analysis of Budget 2025-26

Strengths

Fiscal Prudence: The reduced fiscal deficit (3.9%) and primary surplus (2.4%) reflect commitment to IMF-backed reforms, improving macroeconomic stability.

Social Focus: BISP expansion, education, and health investments prioritize vulnerable groups and human capital.

Structural Reforms: Digital tax enforcement, SOE privatization, and energy sector restructuring address long-standing inefficiencies.

Climate Commitment: Significant climate finance and water investments position Pakistan to tackle environmental challenges.

Weaknesses

Inflation Risk: The 7.5% inflation target may erode real incomes, especially for low-income households.

Revenue Pressure: Ambitious FBR targets require flawless execution, with risks of shortfall if enforcement lags.

Limited PSDP Growth: The Rs1 trillion federal PSDP is modest, potentially delaying critical infrastructure projects.

Tax Trade-offs: While salaried class relief is welcome, taxes on solar panels and e-commerce may hinder green and digital growth.

Opportunities

Global Confidence: Positive ratings from IMF, Fitch, and Moody’s attract foreign investment.

Reko Diq Potential: The $75 billion project could transform Balochistan’s economy and create jobs.

Digital Economy: Tax reforms and IT sector growth position Pakistan as a regional tech hub.

Climate Leadership: Green Sukuk and IMF funding enhance Pakistan’s global environmental standing.

Threats

Geopolitical Risks: Indian water aggression and regional instability could disrupt water and trade projects.

Implementation Gaps: Historical delays in PSDP and reform execution may undermine budget goals.

Public Resistance: Pension reforms, privatization, and fuel taxes may spark protests.

External Shocks: Global commodity price volatility could exacerbate inflation and fiscal pressures.

Conclusion

The Pakistan Budget 2025-26 strikes a balance between fiscal consolidation, social welfare, and structural reforms. With a focus on digital tax enforcement, energy sector efficiency, and climate resilience, it lays the groundwork for sustainable growth. However, challenges like inflation, revenue collection, and project execution require vigilant oversight. The budget’s success hinges on effective implementation, provincial coordination, and public support. By leveraging opportunities like Reko Diq, SIFC, and global climate finance, Pakistan can navigate its economic challenges and achieve its 4.2% growth target, fostering prosperity for its citizens.

Note: This analysis is based on the proposed rates and policies as of June 10, 2025. Final rates and regulations may vary upon official enactment.

Read more about the Economy, News and Announcements here.

One Comment